Mr. Hudack started his career in real estate, managing transactions for Fortune 500 companies. In addition to negotiating, executing, and closing acquisitions for sales and leases, he started and operated his own businesses. He has served as corporate and litigation counsel to community associations throughout California. Joe earned his Juris Doctorate from Western State College of Law, magna cum laude, so he could expand his practice and use his talents to assist clients with estate planning, business law, contract review and drafting, and real estate law services.

How Heirs Can Stay Informed About Probate Case Progress Navigating the probate process as an heir can be daunting, but staying informed about the status of the case is crucial, especially when it comes to Probate Case Updates. Here’s a guide to help you keep track of developments and ensure your rights are protected: Automatic…

Creditor Attorney Guidance – Do I Have to Pay Creditors Out of Pocket if I Am a Beneficiary and the Estate is Short on Funds? In general, beneficiaries are not personally responsible for the decedent’s debts unless they were involved in deceptive practices or benefited from the assets shortly before the individual’s passing. The law…

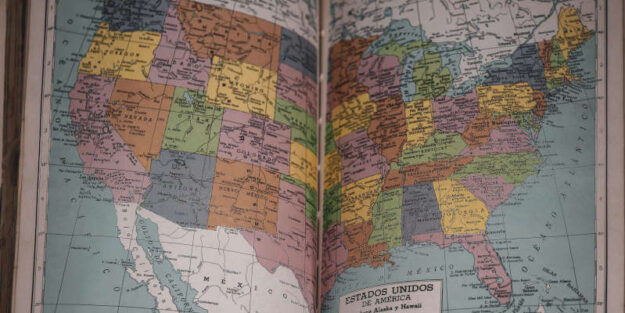

Navigating the Complex Landscape of Probate in Multiple States Dealing with the passing of a loved one is already a challenging experience, and matters become more complex when the deceased holds real property in multiple states. In such cases, the probate process can become intricate, as each state has its own rules and regulations governing…

Ensuring Fair HOA Board Elections: Access, Rules, and Equality Homeowners’ Association (HOA) board elections are critical events that shape the future of a community. Ensuring fairness throughout the election process is crucial for fostering a harmonious living environment. In this article, we delve deeper into the importance of equal access to association media and common…

Key Differences Between Probate and Trust Administration Probate and trust administration are two distinct processes involved in managing an individual’s estate after their passing. Understanding the differences between these two can help individuals make informed decisions when planning their estate. In this article, we’ll delve into the primary distinctions and advantages of trust administration over…

Arguments Against Probate Procedure Probate procedure can be a daunting process for families dealing with the loss of a loved one. Beyond the emotional challenges, the financial and time-related burdens associated with probate can exacerbate the difficulties faced during an already challenging time. 1. Financial Strain: One of the primary arguments against probate revolves around…

Navigating Estate 2024 Planning Amidst Potential Tax Changes In the ever-evolving landscape of estate planning, the year 2024 holds particular significance as a pivotal point for proactive strategizing. While concerns about potential retroactive tax adjustments linger, it’s crucial not to let uncertainty stall your planning efforts. The Biden Administration’s assurance against retroactive tax changes provides…

Strategic Estate Tax Planning Estate tax planning is a crucial aspect of managing one’s financial legacy and ensuring that the assets accumulated over a lifetime are transferred efficiently to future generations. In this article, we will explore the concept of “Freezing the Size of the Estate” as a strategic approach to estate tax planning. Understanding…

Understanding Ancillary Probate Ancillary probate, a vital aspect of managing assets across state borders, comes into play when a will includes properties from multiple jurisdictions. This multi-jurisdictional probate, often necessary due to the diverse locations of assets, requires a unique set of considerations. State-Specific Probate Requirements In any state where the deceased held property, probate…

The Importance of Basic Contract Templates Entering into agreements involves a complex web of rights and responsibilities for all parties involved. Ensuring a fair and legally sound contract is crucial to avoid potential disputes and legal complications down the road. One valuable tool in this process is the use of basic contract templates, providing a…